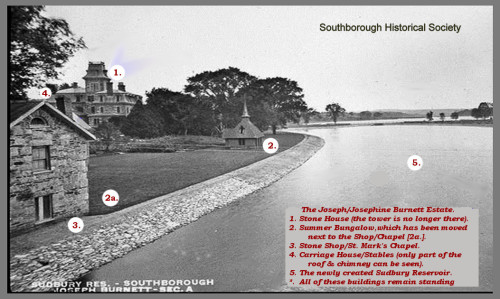

Above: If approved by Town voters, in four years the view of 84 Main Street from the Sudbury Reservoir could look a lot like this again (sans tower). (Photo circa 1900, from Southborough Historical Society website. Click here to enlarge.)

Earlier this week, selectmen told residents they were close to a deal with the owner of 84 Main Street. They believed a deal was imminent. They were right.

Following the meeting, an agreement was reached. The Town and property owner issued a joint press release sharing the news yesterday afternoon.

The “agreement in principal” would pay the owner of the Burnett/Garfield estate $750,000. (That’s $550,000 less than Jon Delli Priscoli asked for in his recent public statement.) The funds are specified to come from Community Preservation Act funds.

It’s a deal that would need to be ratified by Town voters. Their expectation is to hold a Special Town meeting sometime after January 15th.

In exchange, Delli Priscoli agrees to permanent prohibitions on demolishing any structures and subdividing the land. First purchase rights are given to the Town for any future sale, and can be re-assigned to a charity. And the Town will have access rights for specified events (including for schools and Historical Commission).

The deal would charge the owner with applying the funds to restoring the estate “in the spirit of the original 19th century Frederick Law Olmsted design”. This extends well beyond renovations to the Stone House.

The deal specifies removal of invasive species, restoration of landscape, and seeking to relocate the Summer Cottage to original placement overlooking the aqueduct. (Click here for illustration from Southborough Historical Society website.)

The work comes with a four year deadline.

One stipulation could shed light on the owner’s vision of the property’s potential. Converting the Stone House to an 8 bedroom B&B or the Carriage House to an antique shop would require seeking a use variance.

Recently, Delli Priscoli granted an interview to Southborough Access Media. In it, he said he planned to convert the 11 bedrooms into 8 bedrooms each with their own bathroom.

[Editor’s Note: I forgot to include that Delli Priscoli has publicly stated that he and his wife plan to live in the house when the renovation is complete. If the deal falls through, he plans to sell the property – currently approved for development as four lots.]

For past stories covering the homes history and preservation saga, click here. For a photo gallery of the home and estate shared earlier this year, click here.

Below is the full release from the owner’s representative Doug Pizzi and Southborough Town Administrator Mark Purple.

Town and Burnett House owner reach agreement in principle

Town Meeting voters will have final say over fate of historic property at 84 Main StreetSOUTHBOROUGH – The Town of Southborough and the owner of the historic Burnett House have reached an agreement in principle to preserve the house and property in perpetuity while restoring the historic property to its 19th century splendor, which includes a deed restriction that would ensure that the four structures on the property are never demolished and the overall parcel never subdivided.

The Board of Selectmen, after discussing the matter with residents Tuesday night, met in executive session later that evening to hammer out final details of an agreement that will have the Town purchase all development rights to the parcel for $750,000 in Community Preservation Act funds, all of which would be reinvested in restoring the property. In addition to the demolition prohibition, owner Jon Delli Priscoli would agree to a deed restriction that negates in perpetuity all rights to subdivide the parcel, currently approved for four lots and appraised at $2.1 million.

The agreement will still have to be approved at a Town Meeting, which could be scheduled some time after January 15, 2015, allowing for the meeting to be properly noticed and advertised at least 45 days in advance.

“This is a win, win situation for the Town and for my family that saves an irreplaceable cultural and historic resource for all time,” Delli Priscoli said. “I hope that the majority of Southborough residents see it that way.”

“Based on the reaction to plans announced by a potential buyer earlier this summer, we know there is broad support in Town to keep this property intact,” said Selectman John Rooney.

Selectman Paul Cimino added, “Our tremendous historical assets in Southborough, like the Burnett House, all help define what makes our Town special. But people can differ on the question of preserving this property, so ultimately the final decision is exactly where it should be, in the hands of Southborough voters.”

Negotiations between the Town and Delli Priscoli started earlier this summer, after Delli Priscoli rescinded the sale of the house to a Westborough developer intent on tearing the house down and building four cottage style homes on the property. Talks concluded this week when the board informed him of the final details of the agreement by phone.

Town counsel and Delli Priscoli’s attorney will now put the details into a proposed contract subject to Town Meeting approval. Anticipated features of the agreement are as follows:

The Town would receive:

1. Ongoing property taxes on the property at the normal rate – no special deal.

2. A comprehensive Preservation Restriction covering the entire property evidenced on a recordable deed, existing in perpetuity:

a. Permanent prohibition against demolition of any structure on the property;

b. Permanent prohibition against subdividing the land (to remain a single large lot);

c. Owner waives all present and future development rights;

d. Permanent open space restriction protecting historical view of grounds and structures;

e. Permanent prohibition of unnecessary cutting of monumental trees, except upon consultation of owner’s arborist and Town tree warden at Owner’s expense;

f. Town to have right of first refusal on any future sale of the property outside Owner’s immediate family, which Town would be allowed to assign to a non-profit or charitable entity .3. Additional contractual commitments by Owner, as follows, at Owner’s expense:

a. Complete period restoration of the exterior and interior of main House over the next 48 months. Chapel, carriage house and Summer Cottage to follow;

b. Relocation of Summer Cottage to original position overlooking aqueduct, pending Town approval;

c. Pending DCR and Conservation Commission permission, complete removal of invasive species and other vegetation along aqueduct to restore entire bank to 19th century appearance;

d. Exterior landscape to be in the spirit of the original 19th century Frederick Law Olmstead design;

e. Permanent maintenance of isolated grass area on corner of Deerfoot and Main, including placement of a low-lighted historical marker and house sign;

f. Cooperation with Town on the Main Street reconstruction project, as it relates to curb cuts, sidewalks, landscaping and stone walls;

g. Access to the House for educational visits by Southborough Schools, Historic Commission and other specific agreed upon events;

h. All proceeds received by Owner must be used for restoration and invested into 84 Main Street.

i. Owner agrees to seek necessary use variances to allow use of the main House as an 8-unit B&B and/or Carriage House as an antique shop.The Owner would receive:

1. $750,000, which would be drawn from currently-available Community Preservation Act funds, pending CPC and Town Meeting approval.

2. Cooperation of Town in obtaining DCR and Conservation Commission permission to remove all invasive plants/brush along aqueduct to 19th Century appearance.

3. Approval from Town to relocate Summer Cottage to original location at rear of main House.

4. Assistance from the Town to list the house on the National Register of Historic Places.

Updated (11/21/14 9:35 am): Inserted information that the owners have stated they plan to live in the home after renovation if the deal is approved and sell for development if it isn’t.

This is such happy and hopeful news to read! As a great-granddaughter of Joseph and Josephine Burnett,[ and current President of the “Proprietors of the Burnett Burial Park” (behind Episcopal Church)] I have watched this process from start to now near-finish, heart-in-throat and fingers crossed. When others of our far-flung Burnett clan read this news, they too will be thrilled. Much admiration for the foresightedness, determination, courage, skill, and deep caring of Jon Delli Priscoli, John Rooney and Paul Cimino, friends on the Historical Society and Commission, the BOS and Planning Board, Jen Fox, Bridget Brady and their stalwart friends and parents; to Mark Purple, Jennifer Burney, and to countless others of you who have spoken up, put pen to petitions, stumped at the dump, and talked to your neighbors about this important preservation project! It’s been my privilege to get to know some of you a bit in the course of this journey. And it will be a great joy to attend your special Town Meeting and witness the heart of Southborough in action as it approves this far-reaching, precedent-setting agreement!

When we first voted for the CPA there was a very generous state matching. I recall it was about $1 for each $1 of our local tax money that was put into the fund. Like all such examples of generosity on the part of the Commonwealth that match has fallen over the years. Today it is about $0.20 for each dollar we take from our citizens. The bottom line is that the benefit of the CPA structure has been declining over the years and will continue to decline.

I am not advocating for or against this project. I am suggesting that the CPA is no longer the great pool of found money that it once might have been. It is now made up of our local tax dollars. As you think about this project and its merits, ask yourself the following question. “If this $750,000 expenditure came up as a warrant article at the ATM and hit my tax bill the next year would I vote for it?” The reality is that the impact on your tax bill one way or the other is about the same.

At some point we should reevaluate if the extra 1% property tax we levy is still buying us a meaningful benefit or should we just pay for these worthy projects in the regular course of our business.

Al, this is my personal opinion. Having a different pool of money controlled by a different committee is often the only chance these projects can get funding. Take that away, and community projects that provide long-term cultural benefits will rarely move forward when pitted directly against shorter-term “practical” projects. Its the reality of government at any level, and I’m glad that Southborough recognized this and voted to incorporate the CPA in our town to protect these efforts.

So, let me give you a practical choice. There are those that are advocating for full day kindergarten. The monies we spend on the CPA could easily fund full day kindergarten. Is it more important to preserve a private residence or to pay for full day kindergarten.

My choice would be to invest in the children. The future trumps the past. There is a limit to our ability to extract tax dollars from our citizens and this is the sort of hard choice we regularly avoid.

Al, I believe preserving important historical buildings and investing in our children are really one in the same. Education can take many forms. Sometimes it happens school, and sometimes in happens through the rich experiences in life, including living in a community that honors and preserves its own cultural history.

Al –

“The monies we spend on the CPA could easily fund full day kindergarten.”

False choice! CPA funds cannot fund an extended day program for kindergarten–or any other education-related initiative.

***

“There is a limit to our ability to extract tax dollars from our citizens and this is the sort of hard choice we regularly avoid.”

The 1% CPA tax is only paid if you sell your house. If, however, you intend to live in Southborough for many years, the $750K doesn’t cost you one penny. To the contrary, Burnett-Garfield—like our reservoirs, Chestnut Hill Preserve, churches and other architectural landmarks, school system, and proximity to 495/MA Pike and Boston commuter rail—enhances the value of what for many families is their most important financial asset: their home.

(The collective worth of all Southborough homes is $1.67 billion. So with Burnett-Garfield, a one-time $750K investment is a bargain at just 0.04% of the assessed value of all town residences.)

Plus, in contrast to many capital spending projects, our $750K investment does not obligate us to any additional spending. So, we’re not on the hook for paying for a new roof, paint job, or driveway resurface in 10-15 years.

***

Thanks to Mr. Delli Priscoli, Bridget and Jen, and the many other far-sighted Southborough residents for giving us the chance to vote to protect Burnett-Garfield. In a few years after Mr. Delli Priscoli has returned Burnett-Garfield to its original Frederic Law Olmstead design, the property will look great.

Given Burnett-Garfield’s high-profile location, 84 Main Street helps us showcase our town in the best possible light. This opportunity is good for Mr. Delli Priscoli—and it is also good for the rest of us. In January, let’s vote to approve this unique opportunity.

My understanding is that the CPA is in fact funded by our property tax. It is a surcharge on your tax bill and mine.

“Community preservation monies are raised locally through the imposition of a surcharge of not more than 3% of the tax levy against real property, ”

http://www.communitypreservation.org/content/cpa-overview

I merely pointed out that if we were to withdraw from the CPA we could then fund a fund full day kindergarten at no net increase in our property taxes. If that choice was presented to me I would take it.

Al –

‘My understanding is that the CPA is in fact funded by our property tax. It is a surcharge on your tax bill and mine.’

My mistake…you are correct. CPA is 1% of each household’s property tax, excluding the first $100,000 of appraised value.

So if your home is worth $536,000 (which is last year’s town-wide average), your CPA tax is about $70 per year, or $0.19 per day.

CPA receipts have funded our All-Wars Memorial on Main Street, windows in South Union School, the 131-acre Chestnut Hill Farm, sidewalk repairs in front of the library, a volleyball court, and a playground.

Al,

I’ve known you to be a fair-minded fellow over the years, but your statement is a little disingenuous…..

The relative tax “impact” of spending Community Preservation Act funds on this project is the same impact as spending CPA funds on any other project – namely, ZERO.

Sufficient CPA funds already exist in Town accounts even as we speak, and you know very well that CPA funds may ONLY be expended for certain approved purposes, including (in this case) historic preservation.

Now, you may believe that there are more important CPA-qualified uses for these funds, and you can make that argument. Or you may believe that the benefits of participating in the CPA are no longer justified, and therefore that Southborough should decline to participate in the CPA surcharge at all going forward, and you can make that argument. But you may NOT suggest that there is ANY incremental tax “impact” of expending CPA funds to preserve the Burnett House, and you know it.

If there is a better current use for Southborough’s CPA funds than preserving the Burnett House forever, I can’t think of one. If you can think of one, Al, I’m all ears. But do not suggest that voting “no” on this proposal brings tax relief of any sort to the citizens of Southborough – you know very well that it does not.

The fact is, this kind of project is the exact reason the CPA exists in the first place. COMMUNITY PRESERVATION! Let’s do it.

And on another note, please let’s not get hung up on the fact that the Town will be buying development rights from a rich man. The house can’t help who owns it, and if he’s rich he’s rich. We need this house preserved, and tapping CPA money to do so is an absolute no-brainer. It might be easier if we refer to this as COMMUNITY PRESERVATION not CPA…

Kudos to Selectmen Cimino and Rooney for giving voters this chance. Whether this passes Town Meeting or not, the fact that things are finally moving one way or another in Town is refreshing.

To be clear, I did not take a position yea or nay on this proposal. I have not made up my mind yet. My suggestion was that given the substantial change in the matching funds it is worth reconsidering our participation in the CPA.

The CPA is a tax that we all pay. It is a 1% surcharge on our tax. It is one of the few “automatic” taxes that we do not authorize on an annual basis at Town Meeting (Debt, Overlay Reserve and Retirement Contributions being the others that come to mind).

If, at some future point, we dropped out of the CPA our taxes would in fact go down by 1% (or rise by 1% less). The bigger question I am asking is, “Is there a better use for these monies” I have suggested that if it was up to me, Full Day Kindergarten would be a higher priority. The sums in question would pay for about 1/3 of a public safety complex but there are a lot of unanswered questions about this project.

That Thank You was to “Community Preservation…Kinda”

Whoever you are, THANK YOU! Well said.

Those of you who are concerned about the CPA funds and how they should be used might be interested in an upcoming meeting.

As I wrote earlier this week, the chair of the Community Preservation Committee invited the public to attend their annual public hearing on December 4th.

This is not a meeting on the Burnett House application. The chair (Freddie Gillespie) explained that once an application is submitted for that, there will be public meetings to review it.

This is their annual meeting to and get feedback on the Town’s community preservation needs. It will include an explanation of the Community Preservation Act.

I am deeply concerned with this proposal. I am a proponent for historical preservation especially in our small Town. We have many Town owned historical properties that have gone years without any attention or repair. We’ve been sitting on these properties, and that’s a problem in and of itself. Now the Town is being asked to subsidize a private property owner who made a business decision in 2012 to purchase this property.

I question the manner in which preservation of this property is being considered. I feel very uncomfortable committing our Town’s tax assessed funds to a private land owner for his own private residential use regardless of the land restrictions in place. Furthermore, I am particularly troubled by committing Town funds to a private land owner that ultimately will support his income generating B&B in the main house and/or an antiques shop in the barn.

I’m particularly concerned about the oversight of these funds. Has the property owner’s financials been fully vetted? If he were applying for historical grant funding, they certainly would be. What happens if the $2 million dollar estimated cost of restoration far exceeds that figure, and the property owner does not have the necessary funds to finish the project? If the Town then exercises it’s right of first refusal, will we be on the hook of purchasing a 1/2 restored mansion? There is no provision in this proposal that ensures our money is protected in case of this ill fortune.

Additionally, if the owner is successful in creating an income generating B&B and/or antiques shop and decides to sell the property, will the Town then be in the business of running a hotel?

I bring up these points because the attractiveness of the land restriction, particularly the prohibition of subdividing the land and the Town’s right of first refusal, is truly what the town is paying for. Therefore, if the land owner creates an income generating property, the Town’s interest becomes invalid. Additionally, if the restoration falls short due to financial issues, we are also not getting any value out of this investment. Yes, the property would not be subdivided and built on in the future, but why would the town want to purchase, staff, and support a B&B and/or antiques shop or purchase a house in the midst of renovation? Therefore, we are basically just paying off a property owner who is threatening subdivision and a wrecking ball with $750K, and in turn there is really no true public purpose. It continues to be a privately owned business investment with no Town oversight.

Perhaps if the public had any opportunity to comment prior to the Town’s negotiation process some of these concerns would have been brought to the forefront allowing Selectmen to have a better assessment of what the public wants. I find it hard pressed to believe folks in Town are that willing to deplete our Community Preservation Funds entirely for this purpose. Let’s think about the projects and buildings in the near future that are going to impact our taxes: Main Street (yes there is state funding, but it’s not going to be free), new public safety facility, relocation of the transfer station, and most importantly continued support for our town owned historical buildings including Fayville Village Hall, Police Station, South Union School, and Town House.

I know this topic invoked emotional responses, and I understand that fully. I just hope people consider other non-emotional impacts and financial liability this decision holds on the Town for years to come. I’m not opposed to spending money or increasing taxes on projects that improve our community and the public good. I’m just not 100% certain this particular proposal is in this Town’s best overall interest in years to come.

I encourage people to come to Special Town Meeting this winter and participate in the process. Let’s not just allow a deal that may seem good on the surface but has many unknowns get passed right through without proper public input and vetting.

You may have information that I don’t. But I just want to make sure that it’s clear, that I did not write in the article that the owner is planing to open a B&B and antique shop. I did say it appears to be a potential vision. The agreement requires that if he pursued that, he would need to seek use variance permits for that. He has said that he plans to live there if the deal goes through.

Section 3.i of the proposal allows the owner to explore and apply for a variance to create a B&B and/or an antiques shop. That is the information of which I base my assessment on. If you’re allowing the posibility for this scenario, one has the right to question its potential impacts.

Desiree, the town is getting a lot more on this deal than the owner just look at the list. Also just look at the simple fact that even if the house remained but the three lots were stripped of value -that’s 1.5 million they are giving up . Which means we are only paying half of the real value- (I hope the owners lawyer is half asleep on this deal point)what a good job by the selectman plus we get everything else ! BTW the B and B use is a request from the town not the owner and makes great sense since this will grant even more public access and help out the schools and parents when visiting their kids ( sure beats red roof inn) this is a great deal for the town and we should be very very careful not to miss this opportunity. As far as CPA this project hits on two out of the three items in the law historic preservation and open space. Please get off the fact the owner is living there since without these concessions the town is receiving this house will be lost forever which would be a shame.

This is really simple – I don’t care how much history is in this land – why does this gentleman get access to funds which the rest of don’t. I’d like someone to loan me some cash to rehab my house. He held this town for ransom. Pay up or I’ll sell to someone who will subdivide. There is too much else to spend money on in this town and I cannot support paying more so he can play This Old House.

Just to clarify some points:

1. The proposal is not to give a private owner money to restore his house. The town is proposing to buy a restriction in perpetuity on his deed. And the town is compensating him for the loss in value to his property that results from such a restriction. The town is also requiring him to use that compensation to restore his house, rather than allowing him to just bank the money.

2. You, as a tax payer, will not be paying “more”. This CPA funding is basically waiting for an appropriate “cultural” project to come claim it (i.e. historic, open space, recreation, affordable housing). Its not quite as simple as that, but close enough.

3. The proposed project is not competing against “non-cultural” projects (e.g. new safety building) for funding. Different source, different decision makers. One type does not influence the other.

Hope that helps.

Thanks for the explanation Tim. Because all of these decisions will be made at Town Meeting, the explanations will need to be made on the floor. Not every taxpayer reads this blog but deserves to have all the information.

Ms. Aselbekian, Have you EVER had anything positive to say about our elected officials who contribute so much of their time to our town? You may raise some valid points but your constant negativity to those that volunteer undermines your arguments and at the same time causes many in town to be reluctant to volunteer. No where in your post do you even acknowledge the effort. That attitude is what is wrong about this town.

Dear Mr./Ms. Resident,

Thank you for saying I “raise some valid points” regarding this proposal. I truly appreciate that. I do, however, take great exception to the fact that you deem me a negative person. You see, I don’t know how long you have lived in town, but I was a proud elected official for 6 years serving this community. I also have served as an appointed member of several committees in town. I actually currently serve on one. I have great admiration and respect for anyone who volunteers for boards and committees as it is a huge time commitment to say the least, but that is not the point of this story.

I grew up in this Town, and after 33 years can say I am a life-long resident. When I served as an elected official I fully expected to be questioned and even criticized for the votes I took. Whether you are a local, state, or federal politician, your official record deserves examination and scrutiny when making extremely impactful decisions. I consider a $750,000 investment to be a very significant investment for this Town. I am not being negative about it one bit.

I think you mistake my concern for negativity. I know from personal experience that to be an elected official you must have thick skin. It’s part of the job. I also believe if you are an elected official you don’t need to be thanked for your service every other second. In fact, public service is a commitment one makes to serve the public good not to get accolades or a pat on the back. I certainly never expected that, yet I felt very humbled every time it came up in discussion that I was a municipal elected volunteer.

I’m sorry that you feel I have the “wrong attitude” for this Town. I think the fact that my family and I have lived here as far back as the 1920s, and that I continue to call this Town my home is proof enough that I care very deeply about Southborough. Considering our property values are very good in this Town, I could easily sell my place and move elsewhere. I choose to be here. I choose to participate in the municipal process. I choose to be passionate about certain issues. You see, Mr./Ms. Resident, that is what people do when they care about something.

Thanks for your feedback. If I knew who you were I would gladly ask you to coffee to have more discussion.

Desiree

What is the cost of a Special Town Meeting? I have heard it is expensive.. And where do the funds come from, considering this is such an uncustomary, controvertial gathering.

Very Concerned Resident, You may have summed up the divide on this issue quite well. Those of you who see this as the town getting more than the owner, and the rest of us who just don’t see it. What continues to perplex me is the fact that I believe the current owner paid somewhere well short of $1 million for the property, and yes, I know the economy was down at the time, but now the claim is if he subdivides it, suddenly it is worth over $2 million. Did the Garfield family just drop the ball on this one? And, as far as I can tell my property value hasn’t shot up anywhere even close to those percentages. Just because the money exists in the CPA doesn’t mean it should be spent on a private enterprise especially when buildings under town care are in need of upkeep.

JMO – my understanding of the history here is that the higher assessed value is for the 4 lot subdivision and of course demolition of the existing house. This did not come up until Mr. Moss, who almost purchased the property last Summer, invested in making this land value optimization plan and proceeded to file this for approval with our Planning Board. Based on this, the assessed value jumped. The Garfield’s I assume did not go through that process but I would not look at this as “dropping the ball”. I am not sure but imagine that demolition and subdivision was not their wish.

I do not see this as money being spent on private enterprise but instead to purchase the preservation restriction in perpetuity that can save the house and the open space along with the assurance that all of that money is spent on the restoration.

For seventy years I’ve had my sights on this property, so maybe I see a few things in a different way than some. And I’m a bit passionate about the dairy farming history part; for I was raised on a farm where our own cows produced the milk we bottled and delivered to homes in Marlborough. Like Deerfoot, albeit a small, modest version.

For more than fifty years I’ve been married to a fine artist–gardener–landscape designer who has taught me to appreciate design and observe details. So, when I look at the Burnett property, this is what I see: Not a stone house with grounds. Not grounds with a stone house. I see an arrangement of structures enhanced by our nation’s premiere landscape designer, Frederick Law Olmsted. I see a place. I see within that place a large measure of important Southborough history. And now a visionary newcomer has arrived with the idea of bringing all this back the way it was meant to look, and preserving it for future generations, if the citizens of Southborough will make a contribution to the restoration.

Fair deal! As Bridget Brady has said, “It’s the right thing to do.” Phyllis and I are on board with our future leaders – Bridget, Jen and their friends. Community preservation is not a luxury. Too bad our young people are unable to vote on this.

Respectfully, I see this somewhat differently than Allan does.

I see an old structure that is not very appealing. Sorry – I just do not think the building itself is very attractive.

I see some beautiful trees.

I see $750,000 of taxpayer funds being paid to an individual and any use of taxpayer monies paid to an individual just bother me.

What does not bother me is the comment made by Ms. Aselbekian where she said it would allow …” the owner to explore and apply for a variance to create a B&B and/or an antiques shop.” I have no problem with that. Heck, they’re not going to create a business that sells sex toys or XXX rated DVDs at this location.

I am still on the fence about how to vote on this but I really appreciate the type of leadership demonstrated by Selectmen Cimino and Rooney.