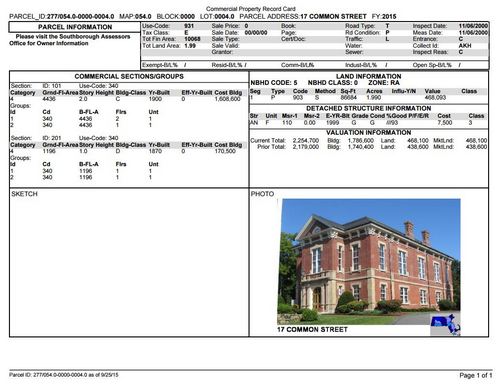

Above: Updated property reports were posted by the Office of Assessors, including one for their home.

The Board of Assessors has posted their annual preliminary property revaluations. Since the board has been working on a major project to reevaluate properties in town, it warrants taking a look before assessments become official.

By state law, the board must post the assessments for a five day inquiry period. That begins Monday, September 28 and closes at end of business on Friday, October 2nd. During this time property owners can ask question about their valuations.

After the 2nd, the town will seek final certification from the State for tax billing.

To see yours and other property assessments (for values as of January 1, 2015), click here.

To make inquiries next week, call the Assessor’s office at 508-485-0720. Or visit the office in the Town House (17 Common Street) during their hours next week. They are open every day beginning 8:00 am. They close at 5:00 pm Monday, Wednesday, and Thursday. Tuesday they are open in the evening until 7:00 pm, while Friday they close at noon.

Over the past couple of years, the BOA has employed inspectors to visit properties in town for updated assessments. Perhaps one has been in your home. Or maybe you excercised your right to deny entry. I’m guessing most missed the visit and ignored the BOA’s letter asking them to schedule a time.

Has the initiative led to any major changes in assessments? I don’t know. (If it did in a negative way, we’re likely to hear about that in comments. So, in fairness to the BOA, if you’re pleased by a valuation, you may want to post that.)

Here’s the BOA’s full notice:

SOUTHBOROUGH PROPERTY VALUES ESTABLISHED FOR FY2016

PUBLIC DISCLOSURE WILL BE SEPTEMBER 28TH THROUGH OCTOBER 2ND, 2015In accordance with guidelines established by the Massachusetts Department of Revenue, the Board of Assessors has completed its annual revaluation of all real and personal property for the purpose of local property taxation.

Massachusetts law requires that all property be assessed at its fair cash value as of January 1, 2015. This is accomplished by analyzing sales and market conditions during the 2014 calendar year. The Board of Assessors has conducted the necessary analysis and adjusted assessments accordingly. Please note, assessments will not reflect calendar year 2015 real estate sales and market conditions until next year (Fiscal Year 2017).

Residential properties have increased in value 2.7% on average while Commercial and Industrial classes have increased in value 8% on average. Personal Property has increased in value 5% on average. These changes reflect overall affects to large classes of property. Individual assessments may have changed more or less than the average.

The Bureau of Local Assessment within the Department of Revenue performs a comprehensive review of the Towns analysis to ensure uniform and equitable property values. Once all standards were met, the Commissioner of Revenue issued the Town of Southborough preliminary certification.

The Department of Revenue requires the Assessors to publically disclose the proposed assessments for a minimum of five business days for the public to view and have the opportunity to inquire about the new assessments before they are certified. This information will be available for review September 28th (8:00 a.m. to 5:00 p.m.), 29th (8:00 a.m. to 7:00 p.m.), 30th (8:00 a.m. to 5:00 p.m.), October 1st (8:00 a.m. to 5:00 p.m.) and 2nd (8:00 a.m. to 12:00 Noon) at the Assessor’s office in the Southborough Town House located at 17 Common Street. Taxpayers may inquire about their new assessments during the disclosure period by visiting the Assessor’s office, calling us at (508) 485-0720 or visiting the Town’s website.at http://www.southboroughtown.com

At the expiration of the disclosure period the Town will seek final certification from the State and finalize assessments for tax billing.

Respectfully,

Southborough Board of Assessors

Thomas J. Beaumont, Chairman Arthur K. Holmes Jeffrey W. Klein

FY16 Personal Property Assessments

FY16 Real Estate Assessments

So today, Monday, I called the Assessor’s office with questions on my assessment, and learned that the assessor is out of office until Wednesday, 9/30. I find it very unfair that for two days of the five day “disclosure period” that there is no one available for questions.

I agree with the previous comment and suggest that the Town delay asking for final approval until the Assessors’ Office is actually staffed for five full days. It’s likely that this absence wasn’t planned but I do think a two day delay mitigates complaints/concerns/challenges.

Is this a Selectmen decision or at Assessors discretion? Anyone know?

The Board of Assessors is elected and is an independent entity. Neither they nor their staff report to the BOS