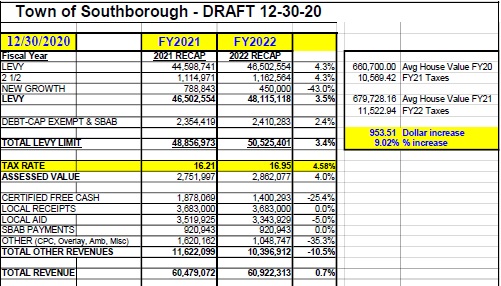

Above: The Board of Selectmen were presented with a preliminary budget for FY22 on Tuesday night. The final version should have a lower tax rate increase, but how much they can reasonably lower it without impacting needed services remains to be seen. (image cropped from meeting packet)

This week, the Board of Selectmen was updated on the preliminary budget for FY22. As is typical this time of year, the projected tax increase is much higher than officials or voters will want to approve. But with small revenue growth and Town services that the public still (or increasingly) rely on, the situation feels grimmer than usual.

The early pass at a budget would translate to a 9.02% property tax increase.

Treasurer Brian Ballantine asked if the Board had a goal the Finance Team should target for limiting the increase. The board’s consensus was targeting a figure at this stage would be arbitrary. Chair Marty Healey called for an increase “as low as possible without impacting important services”. That was a sentiment that appeared to be shared.

The Board agreed to focus on finding cuts in the Operating Budget. At this point, they aren’t looking to cut items in the Capital Expense pipeline for this year.

The Capital Expenses are shown as more than doubled from last year. But, they are only responsible for a 1.78% increase in taxes.

Selectmen referred to the fact that Capital expenses have often been kicked down the road multiple years. In the past they noted that delays sometimes created larger long term costs. Last spring, the Board appointed a committee to study reducing, prioritizing, and recommending better timing for the Town’s Capital expenses. That Capital Planning Committee has been putting in a great deal of work this year. Selectmen indicated they didn’t want to undercut the Committee’s efforts.

[Editor’s Note: As I shared yesterday, the Capital Planning Committee is currently recruiting new members with construction or engineering experience.]

On Tuesday night, Selectman Brian Shea said that when they go over the Capital figures with voters, they’ll need to make clear how much of an anomaly the upcoming fiscal year might be.

As for the Town’s proposed Operating Budget, departments’ requests are shown as only a 4.44% increase over last year. Yet, that budget was blamed in the meeting for a more than 7% projected tax increase. It appears to stem from a revenue situation that puts an increased burden on Southborough taxpayers to foot the bill.

Ballantine explained that each 1% tax increase is the equivalent of $400K in expenses. Lowering the tax increase to less than 5% would require shaving $1.6M from the proposed budget. Board members wanted to learn more about what service and personnel tradeoffs cutting proposed budgets would entail.

Healey advised the Finance Team to go back to “high ticket” departments and tell them “we may not be able to live with” their requested budgets. He asked to find out what it would look like if they cut back their budgets to a 2%, 5% or 0% increase. Selectman Sam Stivers opined that from what he’s observed in meetings, 0% would be too draconian this year. They landed on 2, 5, and 7% increases for now.

Ballantine had also asked if there were any departments that Finance should leave alone. Healey suggested that pressuring departments with only $10 – 40K budgets to make cuts didn’t make sense. Though, at some point they may need to look at what they are spending on. Stivers said that his “sacred cow” was the Public Health Department. He referred to recent budget issues and indicated he supported the path they were on.

Selectmen Chelsea Malinowski asserted that every department was fair game. She opined that they need to be strategic about long term solutions and everyone needed to be team players. She also asked for Finance to break out for each budget anything new since the last year (e.g., new services or personnel hours).

Malinowski asked if there were any new staff positions in the budgets. She reminded that the Board had warned no new positions should be added unless departments were able to identify a new revenue source to offset them. Ballantine and Town Administrator Mark Purple said that they believed the only new “FTEs” were for Public Health and the Town Clerk’s office.

The Board agreed that they would like to meet with the Advisory Committee sometime soon to get their take on the budget situation.

You can look at the preliminary figures presented at Tuesday night’s meeting here.

Our tax has gone from $750.00 per month to over $1100.00 a month in the last tax bill for this year. How much more can you squeeze from us? Cut the budgets and retirement s and the schools. Live within your means like the common folks.

YES! Yes Mike. STOP THE INSANITY!

I have to take from savings to cover the tax increase from last year. Our family is cutting back on food and cutting every line item in our budget. Grocery prices have gone up severely because of demand. Most people have financial constraints now. Many people are unemployed. We count our blessings that we can afford to eat and keep our house, but for another whole year of covid?!!

If you work for the town then be happy you have a job. We appreciate what services the town employees, especially the essential workers, provide but you all have to be honest Can you survive without an increase? Because there are citizen taxpayers who will not. To ask for increases when people are unemployed or standing in line at the food bank is just GREEDY! The Town asking for ANY increase at all is out of the question. What stone are we supposed to squeeze? What rock do we look under for extra cash? Who do we go to for our own increase in income? TOWN LEADERSHIP—YOU ARE CRAZY! ENOUGH!!

Mike

I like all property owners (well at least those that pay taxes) feel the pain. I have lived in town for about 24 years and my taxes have nearly tripled. During that period the price of bread, gasoline, and clothing have not risen anywhere near as fast as the cost of government, to say nothing of wages. It should be further noted that over that period the actual quantity of government services delivered has declined, largely due to reduced enrollments making the unit inflation of government services even worse that it appears.

But, your appeal to the BOS and School Committees (who control 2/3 of our budget) will fall on deaf ears. Why you ask? Because Town Meeting like clockwork approves regular annual tax increases. The only way to break the cycle is for Town Meeting to say no. That will take some organizing and work before the meeting:

1. You must identify specific budgets you want to reduce. Remember, you are not really voting on a budget, you are voting to tax all of us (or at least those that pay taxes).

2. When the Moderator asks if about putting a hold on a specific budget say Hold

3. When debate on the budget in question is put on the floor you need to go to the microphone and say “Mister Moderator I move to amend the budget by reducing it to $XXXXXX”. Make sure you have someone who will second your motion.

4. The clerk will ask you to put your motion in writing. It will help to move things along if you have your motions ready before Town Meeting. I am sure that the Clerk will help you with the proper form before the meeting.

5. Once you have given the Clerk your seconded motion go to the microphone and make your case.

I recommend that you only do this with 2 or 3 budgets to “Send a message” this year and if you prevail and the message is not heard, then step up the game the following year.

Now For The Hard Part – You need to convince a number of people (probably on the order of 50) to come to Town Meeting and support you. A significant number of the regular attendees of Town Meeting have interests in the status quo. There is absolutely nothing wrong with this it is their democratic right and they are doing their civic duty by attending. To change the status quo will require work.

Keeping a democracy takes work and commitment of the governed. Insurrection is the cheap and easy solution that ultimately leads to tragedy. We must do the work of democracy as our forefathers and mothers have done for nearly 300 years. And finally, we must remember, win or lose we are debating not arguing, we are governing our selves not dictating. Always remember, the other attendees are our neighbors with whom we live, work and play and they are doing their civic duty just as you are.

Each year the majority of the school committee budget is taken up by payroll. None of that is negotiable at Town Meeting. The union contracts are public info and if you check them out, you’ll see the yearly raises are generally cost of living raises. We pay our teachers well because we have some of the best in the state and want to retain them. It seems the majority of our students have great experiences at our schools. Our students have impressive test scores compared to the rest of the state. Kids go on after ARHS to college and careers and success. Our special Ed and ELL programs are fantastic. I’ve learned all this by listening to some school committee meetings. Attend some meetings like I have and you’ll learn a lot. It’s easy to via Zoom. You can ask questions at the beginning and end. Or watch on YouTube when the meeting video is up.

A SC member told me that the rest of the school budget increases by a very small amount each year, and the administration and school committee work hard with the town to keep the overall increase low. Just because the schools are a huge part of the budget doesn’t mean they shouldn’t be. Their year to year increase has been very reasonable over the last many years. I would think the same would happen this year.

Mom

To be clear, I am not necessarily advocating the steps I outlined above but am trying to provide information for folks who are concerned about faster than inflation rise in the cost of government and want to do something about it.

Your characterization of the teachers contracts as only cost of living increases is not correct. There are 4 different ways that the costs of our teaching staff increase each year.

1. There is a general increase (this might be called cost of living)

2. There is an increase based on longevity

3. There is an increase based on credentialing

4. There are special increases.

Yes, I have read the teachers contracts many times. I want to live in a community with good schools and that does mean that the majority of our budget will go to schools.

However, it is the teachers contracts, and associated staffing levels that have been driving our faster than inflation increases in the cost of government.

We clearly don’t agree on several of the claims you make. However, I am in complete agreement with your last paragraph. Regardless of our differences of opinion about the role of government, etc., we should all be committed to the democratic process and to equal treatment under the law for everyone. Humanity and compassion before partisanship.

Here is a thought, stop giving the Police Chief huge raises or get rid of him or both. Then hire somebody at a lower amount and then get rid of Mark Purple who seems to not do much at all to help the town. Hit up the schools for their crazy spending and make them give back any overages instead of spending down their budget. Tell them to make do with what they have. Every year if you walk through the halls at the end of the year you see new bookcases, desks, file cabinets, etc. We all would like new stuff but here at home when you don’t have it and the budget is tight you go without. Let’s have them try that for a change. I am sure they have stuff they can use in storage. Stop the insanity of raising taxes year after year, you are killing us!

To borrow from Al’s post above, what is happing is simply the vocal majority keeping the status quo. But it goes much deeper than just budgets and spending in government. Out whole society is based on expansionism and consumption. Just look at the dump and all dumps over the past 1000 years.

Our dump today takes in huge amounts that get burned to generate end energy and they take in recycling that doesn’t really get recycled as much as we hope. It also takes in metal items many of which would be re-used if the residents got back the access that was taken away a few years ago. Clothes and books get donated, lightbulbs and batteries salvaged.

So much infrastructure to take care of what we no longer need or want.

Not that long ago we would have trash and we would have garbage. The former was easily burned or buried and contained little or no toxins or pollutants compared with todays landfills. Metal was salvaged and reused more locally than today. Are today’s largest exports from NY harbor still metal and cardboard?

Garbage was collected separately so it could be fed to the farm animals. Farms and farm animals used to flourish where asphalt and illuminated ball fields run like ant-life blood vessels across the landscape.

It was simpler but we still lived, now it’s more complicated and we are slowly paving and developing everything that doesn’t move, expanding and consuming, an unsustainable cycle we are caught in and will require a serious effort to adopt the change in the baby steps necessary to ensure acceptance and long term adherence.

It’s great to notice waste in schools and budgets and governments and the world around us, it’s quite another to accept any path that will change our current wasteful nature and also accept that it will take hundreds of years to repair the damage we have done in just the last 50.

Could you give specifics as to which schools have these new bookcases, desks, file cabinets, etc every year? What “stuff they can use” is in storage?

Please back up your accusations with facts. If this is all true, it would be very interesting.

As my neighbors have so eloquently stated above – STOP SPENDING – START SAVING!

STOP with the constant increases. LEARN, like the rest of us, to live with LESS.

For the last 40 years, American workers (that includes us, the residents of Southborough) have worked for effectively (adjusted for inflation) the same wages. Why does this town feel entitled to constant increases in spending when its taxpayers are NOT seeing increases in their income?

How much overtime pay did we spend on those guys in blue uniforms to stand with their backs to traffic and B.S. with the construction workers? TOO MUCH!

VOTERS of Southborough!!! Time to WAKE-UP! Attend the Town Meeting and vote AGAINST these OUTRAGEOUS increases in spending!

BOS. Are you SUPPOSED to be representing the VOTERS of this town? Stop sleeping.This budget is Dead On Arrival (DOA).

Zero overtime was spent on the guys in blue uniforms with their “backs to traffic”. Construction details are not paid from taxes, it’s paid by the company.

Want a tax relief? Tell the town departments involved in new construction to stop busting contractors behinds and get some more revenue on the books.

Thank you townie, well said. I am willing to bet that STOP THE INSANITY would be the first one to complain when he can’t get needed help from “the boys in blue”. Good thing he/she didn’t post a real name. While many things that STOP THE INSANITY said are right, I fully disagree with the commentary about the boys in blue.

We had a new driveway put in two years ago which required police details since we are close to schools. The contractor was billed for the police details but the cost was included with our bill. So, yes, the contractor is billed but the cost was passed along to us.

For years the town always talked about their “rainy day” fund and how we need to save that for the days we really need it. Guess what? It’s pouring.

Is there visibility to how much money is in the rainy day fund? Could it have a material impact on the proposed tax increase?

I’ve only heard rumors of it pushing, if not north of 7 figures. Rumors though. I’m sure it would have some what of an impact on taxpayers as a payback, but I’m only guessing. Nothings free right?

Stabilization funds should only be used for 1x expenses – not to fill ongoing operating expenses. Also, the level of the fund should be compared relative to the size of the budget – and from that perspective we are way underfunded interns of the stabilization fund level. Pension and Opeb costs are budget busters – need to watch how much our incremental tax revenue is going to just cover those cost increases rather than towards increasing services…it’s a problem a lot of communities face because of poor pension and opeb funding policies from the past.

How short our memories are. Our Town Administrator and Finance Director bring initial budgets forward that are scary. Without fail, they come down dramatically when they reach ATM.

2020 ATM with a FY2021 tax increase of 0.9% from what was first presented at 5.69%.

2019 ATM with a proposed 3.82% FY 2020 tax increase from what was first presented at 10.37%

On the FY 2020 budget:

https://www.southboroughtown.com/sites/g/files/vyhlif1231/f/minutes/2019-12-17_bos_minutes.pdf

“Brian Ballantine, Finance Director – FY 2021 Budget update Mr. Purple gave an overview of the budget submittals and stated the current tax rate increase for fiscal year 2020 will be 5.69%.”

On the FY 2019 budget:

https://www.southboroughtown.com/sites/g/files/vyhlif1231/f/minutes/bos-11.7.18.pdf

“As the budget stands, the tax rate would have to increase to 10.37%, which includes 2.75% for the public safety building.”

Ask the schools to check the garage at Neary and the Storage area known as the Bowling alley at the high school. Bet they won’t let you see anything there. Ask Deb Kutch about her picture inventory. My “accusations” are right on point. The spending at the school level is insane. Just the Superintendent’s Office alone costs a fortune in salaries because everyone is a manager not a worker. You can turn a blind eye which is exactly what school committee does but it doesn’t help anyone with the budget when you do. The School Committee does nothing to keep the budget in line and gives the Superintendent what ever he wants. He cleaned house of furniture when he took the reigns and guess who paid for it all…we did. Totally unneccesary. School committee should be going through the bills one by one and know exactly what is being paid. Instead they just sign off on them. No accountability.

Here’s a democratic way of opposing the budget, whatever the tax increase will be, for those who are fed up and detest public speaking. It also has the added value of making you act just like most politicians by being a hypocrite. Why isn’t it called systemic hypocrisy to present a possible tax increase only to have that increase lowered every year.

Be a good citizen, go to town meeting, listen to the presentations and vote yes on all spending. No need to upset your neighbors with their pet spending item or look like you are not supporting the schools.

Then go to the polls and vote the budget down.

Think about all the elected officials who have let you down by running on a promise and never coming close to fulfilling that promise. This is the mindset needed when you enter the voting booth. This is how you send a message. Yes, most of our local officials are hardworking people who mean well, but it isn’t working for taxpayers.

I agree with you Al, and your approach is very balanced and thoughtful. There’s also I think and I haven’t looked this up but I think our school district in Southborough alone may have upwards of 50 special-needs teachers. And in some cases those are 1 to 1 relationships.

I was telling this story to my kids at Christmas and when I was in high school there were two classes in the sunniest most part of the school for special needs young adults. One classroom was grades nine and 10 in the other classroom was grades 11 and 12. They were the most joyous classrooms in the school. Often times I would go by on my way to science class and say I wish I was in there honestly. I’m not saying that’s the answer, I’m just saying that’s the way it was and that’s my perception.

I also think Al Hamilton’s suggestion of having 100 to 200 people on the same email list that could vote in unison against the budget, is a great idea. If I were going to be in Southboro for another 20 years I would hit this up. The unions, hold too much power. Furthermore the state sends down unsent funded mandates after they partially fund the program for one or two years.

It’s like all politics, And education is big politics in this country, unless you stand up in unison, and you have a good recommendation, nothing will happen.