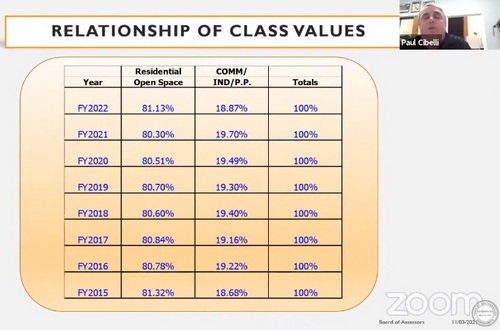

Above: Opposing trends in residential and CIP property values will impact residents’ property tax bills. (image cropped from presentation on YouTube)

Assessors are projecting a larger tax increase for residential property owners than was projected last spring. Based on concerns that included longer term impacts, the Select Board chose not to approve using federal ARPA funds to make a one time difference in next year’s bills.

The discussions and decisions were covered in two back-to-back items on Wednesday night. The Select Board met with the Town’s Assessor about the assessments and a consultant on allowed uses for American Rescue Plan Act funds.

Property Tax Projections

In May, Town Meeting voters were told that approving the Town’s budget would cause a projected 3.19% tax increase for the average homeowner in Southborough. This week, the Town’s Assessor explained why that figure is jumping to a projected 5.43% increase.

The big difference isn’t an increase in the total funds the Town needs to raise through property taxes. It’s based on a shift in the tax burden from Commercial and Industrial property owners to owners of residential properties.

Taxes are charged based on property values. Residential values have been spiking while CIP values have dipped. (Scroll to the bottom for more details on the presentation.)

The annual Tax Classification Hearing will be held on November 16th. However, Assessor Paul Cibelli told the Board he needed information this week if he was to change plans for setting the tax rate.*

The Select Board’s unwillingness to vote that night on specific ARPA fund uses appeared to eliminate the possibility of lowering rate for 2022 bills.

Considering Use of ARPA Funds

At a meeting with the Advisory Committee, the Board heard about the uses it can put $3,051,241 in one-time, eligible American Rescue Plan Act funds towards.

One allowable use was paying for certain items under the approved FY22 Budget, therefore lowering the property tax burden. The Assessor’s office, Finance Team, and a consultant warned that using non-renewable funds to decrease taxes one year magnifies the increase in following years.

Next year’s tax burden situation is expected to be even worse given the trends in property values. (Assessed values are based on values as of January 1st. Residential property values have continued to climb this year. Meanwhile, commercial properties are still having vacancy issues.)

Board members decided they weren’t prepared to vote on earmarking funds without first seeking public input.

Members of the groups stressed that the $3M offered a singular opportunity. Select Chair Lisa Braccio noted that the ARPA funds are funded by taxpayers.

Advisory Chair Kathy Cook and Select Board member Sam Stivers discussed the potential of using some ARPA funds to lessen the sting of this year’s tax bills. Cook estimated that using $440K would lower the tax increase to below 4%. Stivers posed the possibility to use half that to bring the increase to under 5%. He pointed out that part of why voters elect them is to make decisions like these.

In the end, the Select Board voted unanimously to appoint a Working Group to solicit input and consider possible uses for the ARPA funds.

ARPA Working Group Concept

The group will include three Citizens-At-Large who do not serve on any other boards or committees. (They hope to attract residents who haven’t previously served on committees.) It will also consist of two representatives from the Capital Planning Committee, one member of Advisory, and one member of the Economic Development Committee.

The charge will be voted on at the November 16th meeting. Braccio said she wanted the group to reach out again to all departments to make sure they know about any potential projects they are looking for. She also wants a public survey or 1-2 input forms as part of the process.

The group will be assisted by consultant Capital Strategic Solutions (CSS). CSS will vet that any proposed projects are ARPA eligible. The group will report out to the Select Board who will make the decision. The Town has 3-4 years to spend the funds. Ideally, the Board would like a recommendation in time to plan for the Annual Town Meeting.

More Details on the Tax Rate projections and changes

Assessor Paul Cibelli laid out the Timeline for the Assessor’s Office’s determination of Property Values. His slides included ones that showed that changes in past years didn’t cause a significant adverse impact on residential rates. He presented that this year the increase to total property rate values was 3.76%. Residential went up by 4.83% while CIP went down by 0.6%, a 5.63 gap.

Last spring, the Finance Team, Advisory and Select Board members made the mistake of basing average single family home tax increases on past years. This week, they discussed the need to run a number of conservative financial scenarios this winter for projecting tax impacts on FY23.

No mention was made of exploring splitting the Residential and Commercial tax rates. The potential is generally included in the Tax Classification Hearing. However, the Assessors have consistently recommended against it. They’ve explained that the ratio of properties means that making a significant reduction for residents requires a much larger increase to businesses.

*Normally, the Tax Rate would already have been set by now to allow the Town to prepare to issue tax bills for the 1st Quarter of the calendar year.

The Tax Classification hearing is normally held in October. This year, the hearing was pushed to November to allow for the possible impact of items in the Special Town Meeting. After learning in late October of the projected tax rate change, Advisory and the Select Board agreed to ask STM voters to approve funding out of the “Free Cash” certified in July, so as not to add to the FY22 budget burden.

WOW! I’d be speechless if I wasn’t so angry. Same week the EDC’s Housing Plan passes at Town Meeting, and we get the news of an astounding tax increase. An increase which is attributed in part to lost business revenue and shift in tax burden from commercial to residential. While EDC works on pipe dreams Downtown, the hard work that needs done out on Route 9 is non-existent and the commercial tax base crumbles. So residents get to pick up the tab. BOS needs to apply ARPA funds to lower taxes and Advisory needs to squeeze every dime out of budgets and not take no for an answer. BOS, this is UNACCEPTABLE, shameful, and frankly despicable.

When does it end? We increase budgets year after year, nobody cuts anything and the residents are again left holding the bag when it comes to taxes. Mr. Stivers, we voted you in to make the hard decisions, as you say but not to take every last dime out of our pocket. If the BOS cannot do what is appropriate for the people of this town, many of whom are struggling to keep their heads above water, then they should not run again or be voted out. Your duty as BOS is to those that elect you and to do what is right for us. Raping and pillaging the village is not what is right. Enough already!

Spend the federal dollars on us! No need for a consultant. Save that money and keep your promise on the upcoming tax increase.

Here’s the strongest reason to get out of Dodge. Taxes through the roof, BOS and Advisory, have no concern for the tax slugs, that’s us. Higher taxes, and little service. Do I have to sweep my street, or fill in the pot holes. Not impressed with Public Works. All Public Works knows how to do, is cut down trees all over town. So much for conservation. Southborough has always had officials who thought last of the residents needs, and concentrated on their own interests. The governing bodies have all forgotten, that they should be working for us. Perhaps they are confused.

This “problem” shouldn’t ever be a problem. It is easily fixed by splitting the tax rate. The statement “The Assessors have consistently recommended against it. They’ve explained that the ratio of properties means that making a significant reduction for residents requires a much larger increase to businesses” isn’t at all relevant in this context. You can change the ratio such that both residents and commercial parties will still pay exactly what was planned last spring. If the Select Board desired this plan last spring, they need to view splitting the tax rate not as a commercial tax increase, but simply as a tool to control the ratio so they can keep it where they originally wanted it.

I wonder if this is, at last, the turning point for Southborough. Certainly if we are to apply what happened this week in state elections it sure could be a turning point. Of course it will not matter in Massachusetts. No matter who is elected the same old stuff goes on.

There is only one way to fix this: Do not pass a town budget. It is amazing how focused elected, appointed and fully paid government officials can become when their budgets are threatened. How about zero budget increases across all town departments (yes, the schools as well)? No other action taken will result in any real change. This is the only way to get the town back in control of the spending and deal with the real needs. Yep, it will get nasty. But this is what happens when budgets grow out of control.

You know what would also help with this? If the multi-million-dollar-endowed private schools in this town, who own dozens of non-property-tax-paying residential properties, would fairly contribute to support the town services they use. If each of these schools paid “just” the real estate taxes on strictly residential property (not educational buildings or dorms), at the same rate you and I are taxed, it would make a huge difference to the tax bill of every resident of this town.

Couldn’t agree more and every time a property that abuts theirs they grab it up off the market leaving us holding the bag for the loss in tax payments. Too bad we couldn’t block them from buying up any more property. It is time for our elected officials to stop playing nice with these people and make them pay up. It is ridiculous!

In addition, it is time to cut the budget at the school level. Enough on that end too.

why not place a local tax on every property sold to a non profit?

That would be a great idea, but not allowed by law. Any tax or fee assessed to a non profit must pass the three prong Emerson test below, which this would not. I agree it would be great to get the lost revenue from the non-profits, but unless there are changes to Massachusetts Laws, that is not possible.

The Massachusetts Supreme Judicial Court has created a test, which clarifies the difference between a legal municipally imposed fee and an illegal tax. A fee is: (1) charged in exchange for a particular governmental service which benefits the party paying the fee in a manner not shared by other members of society, (2) is paid by choice, in that the party paying the fee has the option of not utilizing the governmental service and thereby avoiding the charge, and (3) the charge is collected not to raise revenues but to compensate the governmental entity providing the services for its expenses. Emerson College v. Boston, 391 Mass. 415, 424-25 (1984). This is the so-called “Emerson Test”.

OK so every time the police, fire or DPW have to go to one of these “exempt” schools, we should be charging them. Put that money into the budget and that will certainly help.

Southsider, because that would be illegal. We prefer to give monies to nonprofits, like the Episcopal church which has billions of dollars in assets.

I wouldn’t tax the non-profit… I’d tax the seller!

The “negotiations” with the schools need kicked into high gear and tax payers need to demand action. Mr. Healey’s attempts to solicit donations produced what amounts to pocket change from these schools. Time to take the next steps BOS. We want to see some real results this time around.

All of the complainers posting above had better start doing two (2) things:

1. SHOW UP for the town meetings and VOTE against the articles that mean tax increases. I keep observing everything pass because all of the zombies in attendance keep voting FOR and almost nobody votes AGAINST. I see people looking around in order to apparently decide how to vote. Maybe spineless zombies is more correct.

150 – 200 people are making decisions about your taxes YEAR AFTER YEAR.

2. VOTE in the LOCAL ELECTIONS. Why do the wrong people get elected to their seats? Because YOU couldn’t be bothered to vote! If (s)Marty Hea(e)ley didn’t follow through on his “get tough and deliver nothing” approach with the private schools, throw the bum out!

Simple.

YOU have control. VOTE. Get rid of the do nothing politicians. I’m thinking of one who cannot seem to be able to shut up. The same one who cannot seem to make a decision. But they can talk and talk and talk and talk…

Better stop wasting funds on litigation against Capital Group, a losing battle for the town anyways, and get those units built! Gonna need them tax dollars.

You’re mistaken if you think those units will create tax dollars and not cost them. Park Central will further bury this town it’s not even close to net neutral. We just passed a housing plan downtown that’s going to look real attractive to a private school with lots of money and oh wait for it, won’t pay a dime in taxes on the units. You got promised restaurants and breweries and will get housing for St Marks faculty and staff.

St Marks could’ve bought any land they wanted and turned it into housing before the bylaw passed.

Private schools get to skirt around regular permitting. Now we have a chance of a tax paying business or mixed use downtown

“Get those units built”

What units?

There is no building plan. Article 10 at special town meeting was a rezoning bylaw. It will allow for future mix used building. It is not a plan to build, it is a rezoning plan.

If you voted yes because you thought you were voting on a building plan to go ahead, then you didn’t understand what the vote was for. It will be years before we see any change on Main St.

Townie seems to be referring to the Park Central project off Flagg Road that is under appeal in court.

The $3+ million should be used exclusively for tax relief this year.

The town bureaucracy very much wants to treat this as “Found Money” that it can spend on things outside of the authorization by town meeting. They site the need to “manage” the increases in tax rates so as to prevent sticker shock. This is the “Boil a Frog” approach where the taxpayers are the frogs.

There are 2 reasons why this approach is deeply flawed.

First, if there is a pressing need for public spending on some worthy purpose the powers that be have no reason to fear putting that purpose in front of town meeting. Town meeting has been unfailingly generous in supporting all manner of programs that it has been asked to raise taxes for. Using “Found Money” as an end around to fund things that have not come before our legislature is an insult to this very generous body.

Second the idea that we should manage the rate of increase in our tax bills is deeply flawed. If I expect to pay $8000 in property taxes this year and $9000 next year am I not better off paying $7000 this year and $9000 next year even though the rate on increase between the years is higher? These monies should be used in the broadest way possible to provide relief to the most number of people. That means that they should be used for tax relief, not public spending.

This frog does not want to be boiled.

I 100% agree with Mr. Hamilton. There’s already talk of significant hikes in next year’s taxes… why not use this money to soften the blow NOW.

Agree fully. ALL and any available funds need to go to offset tax increases now! And stop spending. No more taxes, people can’t afford it!! For goodness sake, open your eyes! Just came from the food pantry to drop off items, please let’s all remember all of this, and especially those in need! There is hidden and not so hidden poverty. Heating fuel, gas, transportation, food prices, and now this: tax increases?!! Stop spending. Town residents, especially seniors cannot afford this never ending lack of control and spending. There are so many vulnerable residents in town. All ages. Residents need a break. This is too much at the wrong time. With the pandemic, there needs to be cuts not increases.

It is inexcusable to have this much of a miscalculation. Mr Cibelli and the finance team should have been all over this. Market trends did not just appear. To tell the tax payers such an egregiously wrong number for the proposed tax increase is negligence. The BoS and Advisory shoulder some blame but the ultimate responsibility belongs with the Town Administrator, Mr Purple, (who is paid more than the Governor). This would never fly in the private sector. Then the BoS does what is always does to avoid responsibility, it forms a new committee.