Although the Town hasn’t yet set next year’s tax rate, the Select Board is predicting that residents will be paying an average of 5.89% more in taxes year.

On Monday night, Select Board Chair Kathy Cook reported that the Town Assessor had completed his analysis. She stated that he found an even bigger shift in the residential vs commercial property assessments over the last year than the Town had prepared for.

The shift is the difference in the total value of assessed residences in Southborough vs commercial and industrial properties. When the Town sticks with its historically single rate tax model, that puts a larger portion of the tax burden on residents than businesses.

The Town grappled with a similar problem last year when the town saw a surprise, unprecedented 5.63% value shift.*

During this year’s budgeting season, officials sought to avoid a repeat in unexpected tax hikes. The Finance team built in a “conservative” assumption of a 12% value shift. The actual shift was 16% (⅓ bigger).

Cook told the Board that the “good news” was that the Town’s average house value increased from $690K last year to $803.5K this year. She confirmed that was the ave/mean, not the median.

The result of the shift is that residents who were told that passing the budgets and Articles at Annual Town Meeting would result in a 4.1% tax bill increase** should expect that to be closer to 6%. (That’s on average. The change in assessed values does vary by individual home.)

In discussing possible “mitigation” Cook said Assessor Paul Cibelli agreed to release an extra $100K from his “overlay” funds. She also hoped they might be able to convince him and the Town Accountant to incorporate more of the “local revenue” in their fiscal projections. (That would reduce the amount of funds to be raised through tax levies.) But she acknowledged that calculation it isn’t in the Board’s “bailiwick”.

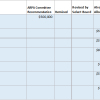

One of the tools the Board does have in its box is federal ARPA funds. The Town is entitled to about $3M. The ARPA Committee made recommendations for how to use the funds, including $500K for reducing property taxes. Before Monday, the Board had only allocated just over $1M in ARPA (including less than half of the tax abatement bucket) and not fully committed to the use of the remaining funds.

The Board has been using the tax abatement category to pay for items that members say would otherwise increase taxes. They picked expenses that wouldn’t be repeated in subsequent budgets but that they also deem as needs they would convince voters to cover.

The Board had previously approved $50K for some of the ADA upgrades in municipal buildings, $59,515 for the Breakneck Hill Farm Dump assessment, $84,500 for the funding gap to fix the Northboro Road culvert, and $8,500 for a consultant to help SHOPC with its affordable housing work required by the state related to the 5 Year Housing Production Plan and MBTA Communities.

The Board had previously approved $50K for some of the ADA upgrades in municipal buildings, $59,515 for the Breakneck Hill Farm Dump assessment, $84,500 for the funding gap to fix the Northboro Road culvert, and $8,500 for a consultant to help SHOPC with its affordable housing work required by the state related to the 5 Year Housing Production Plan and MBTA Communities.

On Monday, the Board focused its ARPA discussion on taking the sting out of additional funding items on next week’s Special Town Meeting Warrant. They agreed to use the $100K from the Assessors to cover part of the $152K on the Warrant for the backlogged tree removals. The remaining $52K, plus $5K for Town Meeting “clickers” will be covered by ARPA.

The $27K for a Pavement Management System was covered by a state grant. They didn’t discuss the additional $24,209 for the Collective Bargaining Agreement and increased insurance deductible. (You can more about the Articles here.) For more detail on the status of ARPA funds, view my sheet tracking the recommendations vs Select Board’s votes here.

On Monday, member Sam Stivers said it might be time to consider a split rate. Expect the Board to address the tax rateat their October 18th meeting – which I believe will serve as the Town’s Tax Classification hearing.

The single vs split rate tax approach has been a controversial one. There have been a few outspoken proponents of the split rate. (You can see Carl Guyer’s most recent letter to the editor here.) When the possibility of the Board approving a higher rate for Commercial properties was raised in the past, there was a public outcry from representatives of businesses in town. One of the biggest public opponents of a split rate has been Chris Robbins who wrote his own letter to the editor on the topic in 2014.

Last year, Stivers and member Andrew Dennington said the change to a split rate was worth considering. Stivers noted there wasn’t much community support and Dennington opined more time and public notice was needed before making that big of a change. You can read about the Board’s 2021 discussion here.

*Last year’s problem was based on the Finance Team, Select Board, and Advisory Committee applying a financial model based on years of past experience. The pandemic changed those parameters in ways they didn’t understand until last fall. You can read more about that here.

**Prior to Annual Town Meeting, I shared information from documents/meetings referring to the projected tax increase as 4.43%. At the meeting, Cook (who was the Chair of the Advisory Committee) presented to voters that her Committee projected a 4.1% increase.

Updated (10/7/22 1:08 pm): In the comments., Kathy Cook corrected my original figure for the average home value in Southborough. (As we both explain, there were audio issues that night. I heard $893K. But, apparently what she shared was that it is $803,500.)

Beth,

The average/mean value of a residential home in Southborough is $803,500 as of 1/1/22 not $893,000 as you said in your post. 1/1/21 average value was $690,027 for a 16% YOY increase. My guess is that you couldn’t hear what I said based on your post from earlier this week. I’m sorry about that. We had added two microphones after receiving complaints from earlier meetings and one of them did not work on Monday night which was the one closest to me.

Kathy Cook

Thank you for clarifying – as I noted in another post, the audio was terrible that night. I listened to what you said a few times and was convinced I heard that right!