Above: Over a year ago, Town Meeting voters agreed that forming a committee to inform officials seeking donations from the large non-profit land owners in town was a good idea. Now the committee is seeking more members to help the effort. (image from ATM 2022 presentation)

The PILOT Committee is still seeking residents at-large to join them. The committee is charged with researching information to help the Select Board as they seek ongoing (and hopefully increasing) donations from private schools exempted from paying property taxes in Southborough.

At last night’s Select Board meeting, there was an update on payments agreed to for the fiscal year coming to an end, and the situation looking forward.

Seeking Volunteers to Sign Up

Patty Fiore is the resident behind the Town Meeting Article that spurred the committee’s creation. She shared an explanation for her interest:

My interest in this topic began simply because I am a taxpayer in Southborough and, as a resident of Fayville, have first-hand knowledge of the surge of residential properties being purchased by private non-profits in recent years. All these properties come off our tax roles and it is up to the remaining taxpayers to make up the difference. Unfortunately, we have not seen a concurrent increase in contributions to the town from the private schools to offset the cost of the services the schools, their students, families and employees use. I would like to help work toward a more equitable solution.

She also shared materials from her presentation to Town Meeting voters in May 2022. (She acknowledged that some of the data points are likely outdated.) Click the links to view the handout and presentation.

The committee was created to be a mix of residents and representatives from certain boards/committees. The committee does have a quorum, with reps having been appointed, but Fiore is hoping more residents will join them, bringing their perspectives.

She shared that she expects the groups work will include:

- Estimating the cost of public services (fire, DPW, public school attendance, Police, etc) used by private schools and supported by taxpayer dollars

- Assessing value of all property owned and residential property owned

- Researching the relationship of other towns with their private non profits

- Finding out how potential new legislation (currently stalled) affects these issues

(For more on the last bullet, see the discussion recapped below from last night’s meeting.)

To read their full charge, click here. To apply to join them in their work, click here for the online application form.

PILOT Payments Status

Select Board Member Kathy Cook, has been serving as the Town’s liaison to the private schools over the past year. Last night, she briefed the board and public on the increased payments the Town is receiving. She reminded that the schools can’t be compelled to pay taxes.

Earlier in the meeting, Cook asked Southborough’s state legislature representatives if they believed that could change. She mentioned a bill seeking for non-profits to pay ¼ of their property taxes. State Senator Jamie Eldridge said that version of the bill would be strongly lobbied against by non-profits and unlikely to pass. He referred to an effort to split out houses owned by non-profits — which Southborough had seen an increase of in the past decade. He believed that version would have a better chance.

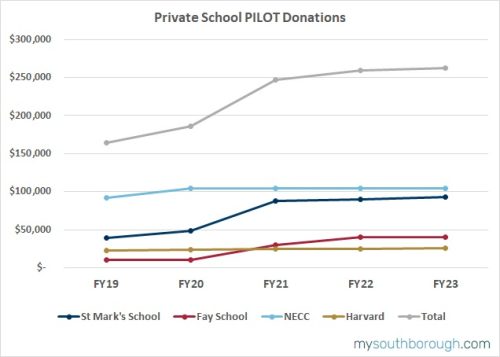

Cook was proud to update that this year’s PILOT Payments would be $262,659. Below is a graph based on the data she shared for growth over the past four years (click to enlarge):

Cook noted that some of the payments that the schools made this year and last were based on specific one-time public safety expenses, split over multiple years. It seemed final payments on those were completed by the donations accepted by the board last night. She also highlighted that both St. Mark’s School and Fay School’s heads will be retiring next June and the Chair of Fay’s board is retiring this year.

She shared data on the payments made by those schools, NECC, and Harvard University (which has a book depository on Pine Hill Road). She said that NECC was good about continuing to make payments based on the taxes it would have owed. But she also acknowledged that the amount was flat over the past few years and needs to be readdressed.

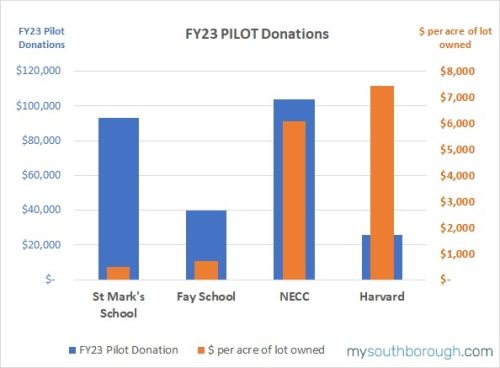

(In a past conversation with Assessor Paul Cibelli, he explained to me that since non-profits don’t owe taxes, the Town’s data on those properties values can become outdated.)

Since % of payments vs assessed values would likely be inaccurate, I took a look at the size of payments made by schools compared to the amount of land the schools own in town. You can view my graph below (click to enlarge):

Some may argue that data it isn’t the appropriate way to judge the generosity/fairness of schools’ donations. To that I say, if you have better ideas, consider serving on the PILOT Committee!

For more background on the context of the Town’s efforts from past coverage, click here.