Above: CPA Articles to be voted on tomorrow cover requests to support initiatives of the Town Clerk’s office, Southborough Trails Committee, and Southborough Golf Club. (scroll down for image credits)

Among the many Articles headed to Annual Town Meeting are three seeking funding from Community Preservation Act (CPA) funds. Project proponents are seeking to restore and preserve historic Town records, complete the Peninsula Trail project (with better ADA accessibility), and improve the efficiency of watering the Town’s golf course. And one Citizen’s Petition Article will ask voters to support changing the Town’s bylaw related to CPA votes.

Here’s my overview.

(For readers not familiar with how CPA funding works, scroll down for my explainer about why CPA funding requests don’t directly impact the next year’s tax rates, but that doesn’t guarantee that there won’t be future impacts.)

29. Restoration of Historic Town Records

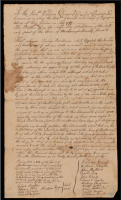

Town Clerk Jim Hegarty has been overseeing a project to preserve and digitize the Town’s old records, and to have the information on each document indexed and uploaded to a searchable, publicly accessible archival database at 01772history.org.

These funds would be used for work related to historic documents in need of restoration/preservation, including ones that date back to the 1700’s.

On the Town Meeting website, Hegarty included three examples from work that has already been completed. I found those examples on the 01772history.org database. Using links below, you can view an image of the original document, an abstract describing the contents, and find out how the document was preserved and where it is currently stored:

On the Town Meeting website, Hegarty included three examples from work that has already been completed. I found those examples on the 01772history.org database. Using links below, you can view an image of the original document, an abstract describing the contents, and find out how the document was preserved and where it is currently stored:

- The May 1727 Petition by “inhabitants of the southerly part of the town of Marlborough” to form their own town.

- 1773 Petition on Rights and Privileges signed by 25 Southborough men

- Report of the Committee on the Form of Government, 1778

The funding request for this project is for $46,046 (including a $1K contingency for unforeseen costs). (The Select Board also approved ARPA funds that cover the scanning of some odd sized documents that require special handling but have previously been restored/preserved, so don’t qualify for CPA funds.)

30. Peninsula Trail Extension

This is the second phase of the project “Bridging the Gap” that was funded in 2021 and started in 2023 to link up three regional trails (the Boroughs Loop/Aqueduct/Bay Circuit Trail), “and close the largest remaining gap in Southborough”.

This is the second phase of the project “Bridging the Gap” that was funded in 2021 and started in 2023 to link up three regional trails (the Boroughs Loop/Aqueduct/Bay Circuit Trail), “and close the largest remaining gap in Southborough”.

The FAQs shared by the Trails Committee Chair describe the Peninsula Trail as a 1.9-mile nature trail that includes .4 mile section of accessible trail (i.e., meets ADA criteria).

The Article is to fund the next phase, which “is critical to rerouting the trail off a dangerous section of Rt.30”.

One of the major goals is to increase accessibility. Funding will cover:

paving/striping/signage for accessible parking spaces (an upgrade to existing parking)

paving/striping/signage for accessible parking spaces (an upgrade to existing parking)- hiring a qualified contractor to oversee and manage the purchase and installation of an elevated boardwalk and pedestrian footbridge

FAQs highlight:

- Adding accessible structures to trails to promote inclusivity and equity allowing individuals with varying abilities to enjoy outdoor activities is our legal and ethical obligation as a town

- We are working with the Appalachian Mountain Club leadership and volunteers to buildout the natural surface trail to be as accessible as possible (adjacent to the boardwalk). While not all the natural surface trail will meet ADA criteria, we are focused on what can be done

The funding request is for $211,232 (including a $27,552 contingency for unforeseen costs).

The FAQs explain that the initial investment costs more than the community might have expected, but “there are long-term savings on maintenance and replacement costs”. The bridge materials proposed have an expected lifespan of 50-75 years.

You can read the FAQs here, and their full CPA project application here.

31. Southborough Golf Club Irrigation System

The funds will be used to fund replacing the irrigation system to more efficiently water the greens at the Southborough Golf Club. It will replace an over 50 year old system “which is leaky, prone to failure requiring frequent repair, and time consuming to operate.”

The funds will be used to fund replacing the irrigation system to more efficiently water the greens at the Southborough Golf Club. It will replace an over 50 year old system “which is leaky, prone to failure requiring frequent repair, and time consuming to operate.”

$50,000 for the project will come out of the Golf Course Revolving Fund from golf fee revenues, but the Town is seeking the majority of the funding through the CPA fund — $553,750 (including a $78,750 contingency for unforeseen costs).

The Golf Club’s Annual Report includes the irrigation as just one of the improvement projects they have planned. Others planned for this year (that will presumably be covered by the Revolving Fund) include:

- Bunker refurbishment throughout course (in progress)

- Drainage improvements for hole #1 (in progress)

- Cart path repair for hole #3

- Additional protective barriers along the Latisquama Road boundary (to continue reducing stray balls)

Those are on top of the improvements made in 2023 that are outlined in the report. You can read that here.

47. Citizen’s Petition on Voting Threshold

As I’ve previously covered, resident Joseph Palmer’s petition seeks to raise the vote threshold to a super majority (2/3) if CPA project funds would go towards:

a project, asset, or service on private land, or for private benefit and use, being not town owned or operated

The inspiration for this was CPA funding for restoration of the St. Mark’s Church clock tower, which was approved 83 votes to 82.

Palmer has argued that if the money is being used for a private entity, there should be a higher show of support from the community. Recently, Palmer was told at a Select Board meeting that Town Counsel confirmed with the Attorney General’s office that the Article conflicts with state law. Palmer responded that he still plans to move forward. If the Article passes, even if the AG makes that ruling, voters’ sentiment will be on the record.

You can read Palmer’s presentation for Town Meeting here.

CPA Explainer

CPA Funds are collected through a 1% surcharge on property tax bills. Those funds are collected whether they are used or not. The projects that can be funded have restrictions and are meant to fall under the categories of Historical Preservation, Open Space Preservation, Public Recreation, or Affordable Housing.

Often officials will seek ways to fund a project that would otherwise be paid through the Town’s general funds to be covered by the CPA. That’s because It keeps down their figure for year-over-year tax increases and expenses are partially reimbursed by state matches.

Projects are often touted as not coming with a cost to taxpayers. But that’s not always the case in the long run.

The fund isn’t unlimited. Funding some projects means that there is less in the bucket for future projects. If those projects are needed/desired enough, they can end up being funded by the tax levy.

It’s also worth noting that the CPA’s future is being debated by Town officials.

The Advisory Committee would like to pursue having the CPA surcharge increased to 3% through a ballot measure, arguing that it would pay off with a higher level of state matches.

Meanwhile, Select Board member Al Hamilton has stated that he would like Town Meeting voters to be given the option this fall to eliminate the surcharge altogether. Hamilton noted that when Town Meeting voters originally adopted the CPA surcharge, it was with the expectation of a 100% state match.

(cover images L-R cropped from Town Clerk’s document on TM website, Trails’ CPA application, and the Southborough Golf Club website, with my addition of the entity seals)

Updated (3/22/24 12:14 pm): I had forgotten to include a link to the presentation for Article 47.

Updated (3/22/24 1:35 pm): I received an updated version of the Trails FAQs, so I replaced the link.