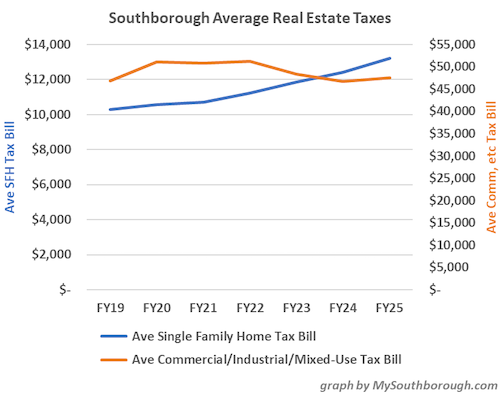

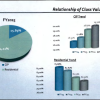

Above: Southborough tax increases are again driven by home values that rose higher than commercial real estate value growth. (image based on data in the Tax Classification hearing presentation)

Last week, the Select Board approved the Southborough property tax rate for 2025. Although the rate is a slight decrease from this year, the bills will increase, especially for homeowners.

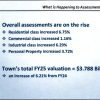

In the Tax Classification Hearing, the public was told that tax bills for homeowners will again go up higher than was projected at Annual Town Meeting. Instead of seeing about a 4% increase, the average single family home tax bill will go up 6.43%

Based on the data, the property tax rate has been set at $13.81 per thousand of the total assessed value. That is a 0.72% decrease from last year. But, given the 6.75% increase in residential real estate values, homeowners’ bills will generally show an increase.

This year, Commercial property owners should also see an increase, but most will see a much smaller one. Industrial property owners may see an increase similar to homeowners. (See image right.)

This year, Commercial property owners should also see an increase, but most will see a much smaller one. Industrial property owners may see an increase similar to homeowners. (See image right.)

The increase again comes down to the Town having failed to accurately account for a continuing differences between residential and commercial property value changes in the prior year. (Scroll to the bottom for the explanation for why that happened this year.)

The increase may not be as bad as that sounds for some homeowners on who are struggling financially and may be worse this year for owners of luxury homes.

The 6.43% increase average is based on the average home value in Southborough. Tax rate impacts for actual bills will vary based on their assessment of what property values as of January 1, 2024. (And those are based on analysis of calendar year 2023 sales and market conditions.) According to the Assessor, the latest data showed the biggest value increases were for higher end homes.

Asssessor Paul Cibelli highlighted that the tax burden has been shifting to residents over the years as the commercial share of property values has decreased. That’s based on increased value of homes, commercial values that decreased, and more development (new growth) in residential properties than in commercial. (See image right.)

Asssessor Paul Cibelli highlighted that the tax burden has been shifting to residents over the years as the commercial share of property values has decreased. That’s based on increased value of homes, commercial values that decreased, and more development (new growth) in residential properties than in commercial. (See image right.)

Later, he also noted that Southborough only has 3,800 taxable property parcels. He pointed out that when other towns like Westborough and Northborough take on expensive capital projects, the costs are spread out over about 2½ as many properties.

Below are some more of the slides from the presentation:

I also created a couple graphs of my own to compare trends in the real estate values and taxe bills for residential and commercial properties since 2019:

Single vs. Split Tax Rate Debate

So, given the bigger increase in residential bills and decrease in commercial bills, why did the Select Board and Assessors continue to support a single rate?

In the hearing, Cibelli again demonstrated that based on the outsized percentage of residential vs commercial properties, creating a small savings for residents would require a large increase for businesses. He calculated that for every $1 a split rate change could save residents, Commercial property owners would see a $4.67 increase.

Select Board Member Sam Stivers said he was still interested in potentially using a split to ease residential taxes. He didn’t believe it would cause a business exodus. Chair Kathy Cook said he may be right, but it could cause some businesses to not come to Southborough.

The board unanimously supported the Board of Assessors’ recommendation for the single rate.

Later, Economic Development Coordinator Leah Emerson told the board she was pleased with their decision. She stated that commercial real estate sales are down 91% in the MetroWest area. She didn’t believe this is the time to implement an increase to the commercial tax rate.

You can read more on the single vs split rate issue in my coverage of the 2022 hearing which included a more robust debate. (You can also read the debate recently raging in comments on the blog here, and prior stories and letters about the split rate here.)

Long Term Solutions

The board has advocated that the only way to improve the tax burden for residents is to increase the value of commercial properties by attracting more businesses into town. They just successfully urged Special Town Meeting to approve increasing the Economic Development Coordinator position to full time to help with that effort.

In last week’s meeting, Cook said the board now needed to roll up their sleeves and get something done on the issues they know need fixing: septic, wastewater treatment, and zoning.

Member Al Hamilton agreed, suggesting they form a Sewage Working Group to make the changes needed to bring businesses to Route 9. But he indicated he believed that would take about 10 years to get done.

Hamilton also advocated that the Town needed to target bringing in about $165M in commercial valuations to get back to a tax base that is 80% residential and 20% commercial. He pointed to large retail stores in nearby towns, like Home Depot and Target, as examples.

He said that bringing in those kinds of projects to Route 9 would not only require zoning changes and infrastructure, but also a change in attitude in this town. (He also followed up on that point with a Letter to the Editor on this blog advocating his position here.)

At the Planning Board meeting the night prior, the board discussed the need to work on zoning changes to the industrial park zoning along Route 9 more welcoming to businesses. (Stay tuned for a post on that effort.)

More background on this year’s taxes

In March, Annual Town Meeting voters were told that the Town’s budget ask would cause a 3.99% increase in the average homeowners taxes. The hall then supported a voter’s proposed increased to fund hiring two additional full time dispatchers. That raised projected taxes to just over 4%.

In late September, I asked Cook about the potential tax impacts if voters passed all of the Town’s Articles at the Fall Special Town Meeting. At that time, I was told that updated tax projections estimated 4.38%*, but that the assessor’s data wasn’t in yet and that could impact the figures. (When I asked what Finance had included for another potential real estate value shift this year, I was told that the calculations didn’t account for one.)

Another Unpredicted Value Shift

In the hearing, Cibelli explained why he hadn’t foreseen a value shift this year. Unlike the assessment of residential property sale values, commercial values are based on income. The businesses’ income statements don’t come back until March or later, after businesses finish their taxes. That means he goes into Town meeting “pretty much blind” about the commercial situation.

Back in 2021, the Assessors Dept. had been blindsided by the size of a huge value shift when residential values spiked while commercial values declined. In the following years, the office helped determine a value shift to expect for that year (though not always as large enough).

According to Cibelli, the early data he had on residential median home values in the prior couple years had showed numbers so strikingly out of norm, that he was able to foresee that residential values spiked enough again to increase to cause another value shift.

According to Cibelli, the early data he had on residential median home values in the prior couple years had showed numbers so strikingly out of norm, that he was able to foresee that residential values spiked enough again to increase to cause another value shift.

He followed that the early data this year didn’t show that. (To be honest, some of the details in his explanation went over my head. You can watch it yourself here and see the data he discussed in the image above right.)

Cook said that she had long discussions with Advisory Chair Andrew Pfaff and with Cibelli. They are discussing how to “predict in a more timely fashion” to avoid a recurring issue. But she acknowledged that the data source for the commercial values makes that a challenge.

*The 4.38% projected tax increase was purportedly based not only on hiring a second Police Lieutenant for half a year but also on updated figures since Annual Town Meeting, including for debt service for a bond which would include the Breakneck Hill cleanup work and other scheduled borrowing.

Updated (10/30/24 12:09 pm): One highlight I forgot to include in covering the Tax Classification Hearing — the Select Board and Cibelli discussed the fact that Southborough is purportedly ranked in the top 10% of highest average residential property tax bills across the state.