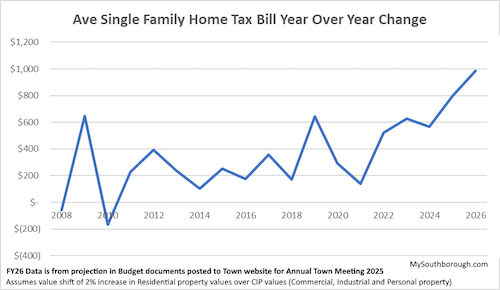

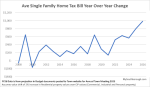

Above: It’s not surprising that the Town is projecting a tax increase next year. But the size of that increase for average homeowners is much larger than usual. (graph created by Beth Melo – updated and replaced on 3/26/25)

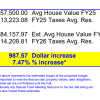

Updated (3/26/25 10:19 am): Since initially posting this story, I discovered that the Town has posted new budget documents that show the final budget included the Warrant is now estimated to require a 7.47% increase in average residential tax bills (not the 7.7% I originally covered was discussed at the Select Board meeting to finalize the budget). I’ve replaced graphics and updated the data to reflect that change.

At the Annual Town Meeting in just under two weeks, the Select Board is expected to ask voters to pass a budget that would create an estimated 7.5% increase in homeowner’s tax bills next year. It’s the largest spike since this blog has been covering Southborough Town government.

It’s important to note that the projection doesn’t incorporate costs for the proposed Neary Building project. (Borrowing for that project won’t be voted on until the May 10th Special Town Meeting and May 13th Town ballot).

The budgets and related tax increases will be voted on at the Annual Town Meeting on Monday, April 7th. The meeting opens at 6:30 pm and you can find the Warrant here. (You can also look for the Town to post details and handouts prior to the meeting here.)

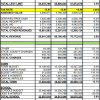

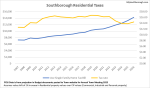

The tax increase of $997.57 is based on the projection that an “Average” single family home will be assessed at over $984K. [Editor’s Note: I’ve replaced below the draft budget recaps and summaries from the Select Board’s March 11th meeting with the final budgets posted to the Town Meeting page on the Town’s website.]:

While the above budgets discussed on March 11th weren’t final, officials didn’t expect any significant changes in the Warrant. And they weren’t optimistic that they would be able to significantly lower any costs by the time Town Meeting takes place. (But as I’m updating on March 26th, the final versions did shave a little more off the initial projected tax impact.)

As always, the estimated figures include some assumptions about local receipts, state aid, and other factors that aren’t finalized until later in the year. This year, the Town is assuming a 2% increase in the residential to commercial value shift. (That’s the gap between how much assessed residential and commercial property values will have increased. In years when the shift has been underestimated, like last year, it results in larger than projected tax bill increases.)

Often the Town has been able to keep tax rate increases down. But property value increases still results increased tax bills. (See my updated charts below.) This year, both are expected to rise.

So, what is behind this year’s big increases?

The main drivers cited are a major investment in public safety staffing, a spike in the Town’s employee health insurance costs, and school budget increases (including transportation costs and their employee health insurance spikes).

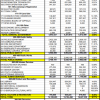

The Select Board also points to the the impact of having been able to temporarily avoid bigger tax increases for the prior two years despite inflation. That was mainly from covering the cost of many “one-time” capital expenses in FY24 and FY25 using money from the federal government through the American Rescue Plan Act. That ARPA funding is no longer available. So now, simply funding items in the normal pipeline of capital expenses represents a surge in what Southborough taxes need to cover. (See this year’s Capital items below):

Police Staffing

Last year, Police Chief Ryan Newell argued that the Southborough Police Department was understaffed and requested adding new positions. The Select Board and Advisory Committee instead pursued a Public Safety staffing study to determine what positions were needed.

The completed study advised the addition of a second Lieutenant and eight additional officers. The study had acknowledged the difficulty of a sudden staffing surge and advised it could be done over four years.

At a Special Town Meeting last fall, voters approved adding a second Lieutenant to begin in January. The FY26 budget will now more than double that cost by covering a full year of salary and benefits.

On top of that, the chief asked to add six new officer positions to next year’s budget. His rationale has included that the increased staff will allow creation of “specialties” which are attractive to officers. And making the job more attractive has been a concern given the Town’s difficulty staffing the SPD.

The SPD has lost several officers and had difficulty recruiting replacements. Part of that has been based on other towns offering better salaries. That’s an issue the the Town is trying to fix during this year’s Collective Bargaining Agreement negotiations. The new CBA in process of being approved will cause an increase in salaries for existing staff positions.

At a budget summit in February, the Select Board initially discussed adding four new officer positions in FY26. More recently, Select Board Chair Kathy Cook recommended lowering that to three officers to be phased in over the course of the year. (That would add the cost of 1.5 officers to the FY26 budget. Even if no additional staff was hired the following year, that would double to 3 officers in FY27.)

Cook argued that it was unlikely that Newell would be able to fill all eight of the staffing vacancies plus an additional position by the start of the fiscal year. And even if positions went unfilled, the Town would still be required to raise those funds for through taxes next year if they are included in the budget approved at Annual Town Meeting.

Newell continued to advocate for all six new positions. He has asserted that with the new CBA, he believes he will be able to fill all of the vacancies for the start of the new fiscal year.

At the March 11th meeting, the majority of the board agreed with Cook. Only Select Board member Al Hamilton argued against adding any new positions. Hamilton has argued against adding any new staff to the Town payroll unless the board can identify equivalent cuts to offset the costs.

Member Marguerite Landry argued that the staffing request should be made to Town Meeting voters so that they could decide whether to prioritize adding the positions or avoiding the resulting tax increases.

Advisory Committee members debated the staffing increase. Although they had yet to vote on a formal position, the committee appeared to also be split on whether to increase staff and by how many heads. Member Tim Martel highlighted that the Town took about twenty years to gradually add the positions recommended in a prior staffing study. He was opposed to making drastic staffing increases.

The cost increases related to increasing police personnel costs are spread out over multiple budgets and Articles in the Town Meeting Warrant. The Select Board discussed the possibility of putting something together to explain the total financial impact of the decision to voters.

Fire Department Staffing

The Public Safety Staffing Study also called for an increase to the Southborough Fire Department staff. The Select Board also agreed to add a Deputy Fire Chief to the FY26 budget. Adding the new position also requires adding a vehicle for the employee.

In the March 11th discussion with Advisory, Chair Andrew Pfaff noted that Chief Andrew Puntini was also wants to add three additional firefighters. He reminded that Puntini agreed to pursue grant funding to cover that cost for the first three years rather than including them in the FY26 budget.

Employee Health Benefits

The Town finance team was shocked by a projected over 10% increase in health insurance for employees next year.

Southborough has been collaborating with the Town of Northborough and the regional school system to negotiate rates with insurers. According to Town Administrator Mark Purple and Treasurer Brian Ballantine, normally the partnership helps offset impacts when one of the plans has an unusual rise in claims. But over the past year, all three plans had a spike in benefits claims. As a result, the insurer raised its fees for next year by a much larger amount than they have ever dealt with. (There was some speculation in conversations with the Select Board that the rise in expensive weight loss drugs was behind the increased costs. Apparently, it is impacting the entire health insurance industry.)

The team is researching its options, including whether gains might be made by partnering with other towns. But that may end up being a longer term solution that can’t be implemented in time for Annual Town Meeting or the next fiscal year.

School Budgets

As I’ve previously covered, an increase in the transportation costs for school buses is also among the reasons for school budget increases.

The Southborough K-8 Public Schools did make some trims to their initially proposed budget. Their updated version now calls for a 3.52% increase over this year’s budget. The additional $853,822 brings the total FY26 budget to $25.1M.

You can view their presentation here. The committee will hold its annual budget hearing tonight at 7:00 pm over zoom. You can find the link here.

The Regional School Committee (for Algonquin Regional High School) voted for a budget with a 6.2% increase for a total FY26 cost of $29.6M. That updated budget didn’t appear to specify how the costs would be split between Southborough and Northborough. [Editor’s Note: That information was posted this afternoon! Scroll down for the details.]

The packet from their March 19th meeting had included a line item summary but not an explanation for the costs. Back in February, the administration did make a more robust budget presentation, including the assessments for each town. But the administration needed to go back to the drawing board after having just learned about the unexpected health insurance spike that wasn’t incorporated in its presented figures.

Prior to learning about the benefits issue, the administration had already recommended spending $675K from its E&D account to reduce the tax impact of this year’s budget increases. (You can read more about the regional school’s Excess & Deficiency account here.)

The Regional committee will also hold its annual budget hearing tonight over zoom. That’s at 8:00 pm, and you can find the zoom link here.

Updated (3/25/25 6:49 pm): In the weekly NSBORO newsletter published today, the Superintendent included the budget books for all three districts. The book for the Regional School includes the clarification that Southborough’s assessment will go up by 6.51% ($615,899). You can read that budget book here. You can see the Southborough K-8 budget book here.