The Advisory Committee has issued it’s report to Annual Town Meeting, along with detailed information on this year’s budgets. It includes an explanation for their budget recommendations, plus the reasons behind some key Articles they voted to support or not support.

The report also comes with some financial forecasts and warnings. The most notable is a forecast that the Town seems to be headed towards needing a Proposition 2½ Override within a few years.

You can view the full report here, their “Budget Brief” attachment here, and the detailed budgets here.

It’s worth clarifying that the report isn’t all doom and gloom.

Advisory notes that the FY25 budget that the Town will ask voters to approve is projected to increase homeowners’ tax bills by approx. 3.99%.* The committee highlights:

In this inflationary environment and economy, we feel it is quite an accomplishment to keep the budget increase below that of the rate of inflation. Thank you to all the various Town boards, committees, department heads, and the finance team that worked hard to accomplish this goal while not sacrificing any services for residents.

But the report goes on to explain why they believe the Town will have to grapple with big fiscal issues between now and next year:

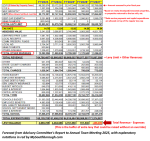

We have seen a significant increase in expenses versus revenue this year, which is causing the town’s excess levy capacity to be reduced much more year-over-year than it has in the past. Furthermore, the inclusion of a significant amount of one-time funding (ARPA, Free Cash) in this year’s budget is anticipated to result in an accelerated reduction of our excess levy capacity, thereby exacerbating the challenge in the future. This is a worrisome trend and is critical for all taxpayers to understand. Most likely the town will have to seek a levy limit override at the ballot box next year to avoid having to reduce town services or staffing. The last time the town approved an override was in 2006, an increase of $228,327. We are currently forecasting a $486,490 levy capacity shortfall in FY 27. This is something that we should address next fiscal year, prior to approving the FY27 budget in the spring of 2026.

I’m assuming that some readers will have trouble deciphering the figures in the table included in the report (as I used to when I first started reading these). So I added some clarifying notes in the image right.

I’m assuming that some readers will have trouble deciphering the figures in the table included in the report (as I used to when I first started reading these). So I added some clarifying notes in the image right.

Warrant Articles Discussed in Report

The Report also goes over Advisory’s decision to support the version of the Police Budget in the Warrant, which doesn’t include the Police Chief’s requested staffing increases. Instead, the committee is asking for:

a third party consultant that specializes in police department staffing needs assessments to complete an evaluation of the current staffing levels and comparisons to current trends and market standards to ensure we have the correct levels.

At the February 27th Select Board meeting, member Kathy Cook explained that the budget includes $25K for that to be done. The intent is to have results in time to make potential staffing decisions at the Special Town Meeting in the fall.

As Advisory’s Report notes,

the delivery of this information will dovetail with a recommendation for the Select Board, Police, and Fire as to whether the Town should pursue moving our dispatch function to a regional emergency communications center (RECC), as that change would certainly alter the staffing levels within the police budget, which is where the dispatch staff is currently located.

Therefore, the committee does not support the Citizen Petition Articles (6 & 7) asking voters to add the salaries and benefits for four new dispatchers to the budget.

They also oppose Article 8 on the regional dispatch topic and Article 47, on vote thresholds for non-Town CPC projects, since neither come with the authority to enforce an action. (The first is advisory, and the second was deemed to be in conflict with state law.)

And Advisory opposes creating capital stabilization funds for the regional high schools (Algonquin and Assabet Valley), explaining:

This article would remove the power from Town Meeting to vote on capital items independent of the operating budgets and we were not comfortable that the limitations of the law were sufficient. . . It is Advisory’s STRONG recommendation that Town Meeting NEVER cede the power of appropriation to any other body.

There are Articles that Advisory is advocating voters pass:

The Library Construction Planning & Design Costs, which Advisory hopes will result in the state reimbursing the Town for a big portion of the project. (You can read more about that Article here.) And they support borrowing for the items under the Capital Budget, based on having been “exceptionally well-vetted” as needed by the Capital Improvement & Planning Committee.

Looking Ahead

Advisory also shared information about initiatives on the Horizon:

- The committee is urging the Town to pursue a ballot question to increase the Community Preservation Act surcharge on tax bills from 1% to 3% in order to make greater use of the state’s partial funding matches for projects.

- They provided some background on the MBTA Communities zoning that will need to proceed to a Special Town Meeting this year. (It’s not on this Warrant, but the Planning Board will make a presentation to update voters.)

- They outline Town HIPAA Compliance issues andsteps they believe need to be taken for Data Privacy Risk Mitigation.

- The committee would like to see more tools/resources to help continue to improve the budgeting process

Voters will convene to vote on the budgets and Articles this Saturday, March 23rd at 10:00 am at Trottier Middle School. For more details on the meeting, you can read the Warrant here, find my coverage here, and the Town’s website with additional materials here.

*The report stresses that at this time of year, the tax increase is just an estimate:

All amounts are estimated as the Town Assessor has not finalized the 1/1/24 property valuations, and there are other factors beyond the approved FY25 budget that determine the final tax bills for FY25. Advisory felt it was prudent to be conservative and provide the most accurate forecast we could.

We should be grateful both the Advisory and Capital Planning committees. They both do the heavy lifting in vetting our budgets and plans. A few observations:

This Saturday at 10:00 we will meet, at Trottier, as a legislature, for the 297th time to decide what services we want from Town Government and how we will pay for them. Our Town Meeting predates Congress. It only works when we, the people, participate. See you there.